ChatGPT launched in November 2022, setting in motion widespread disruption in the technology market. Our experience of prior technology cycles suggests that disruption follows a blueprint. New technologies emerge, usually cheaper and inferior at first. They begin as complements to existing technologies and end up as substitutes.

Three years in and we now appear to be entering the second phase. Incumbents often fare less well in this environment, which is beginning to be reflected in share prices. While Mag7 stocks led markets in the two years following the advent of GenAI, we expect them to be poor conduits for AI returns going forward. This is apparent from a growing two-way debate on AI positioning in many of these stocks, in part due to increasing capital intensity. We believe this necessitates a more selective investment approach.

2025 brings vastly improved AI models at lower cost

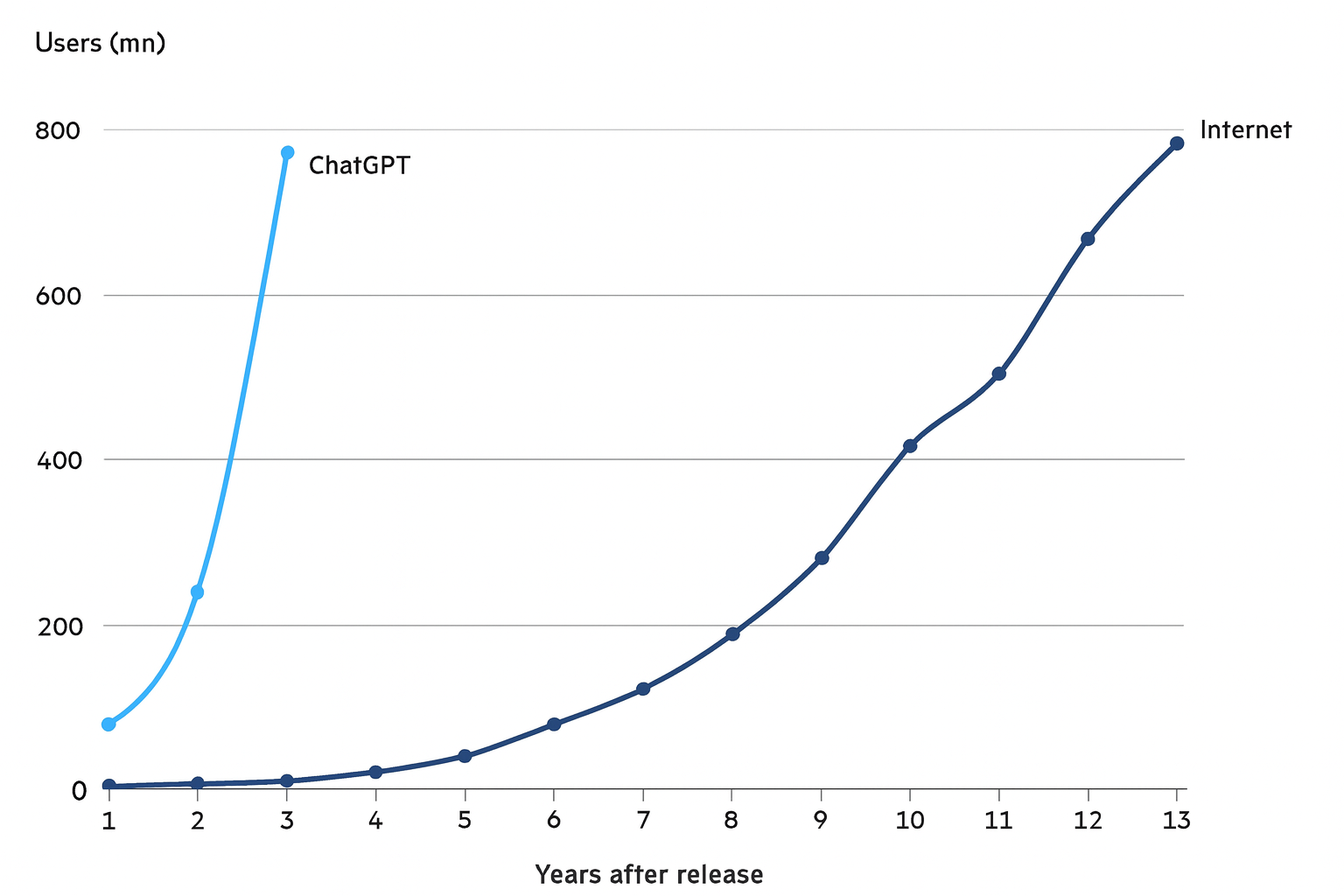

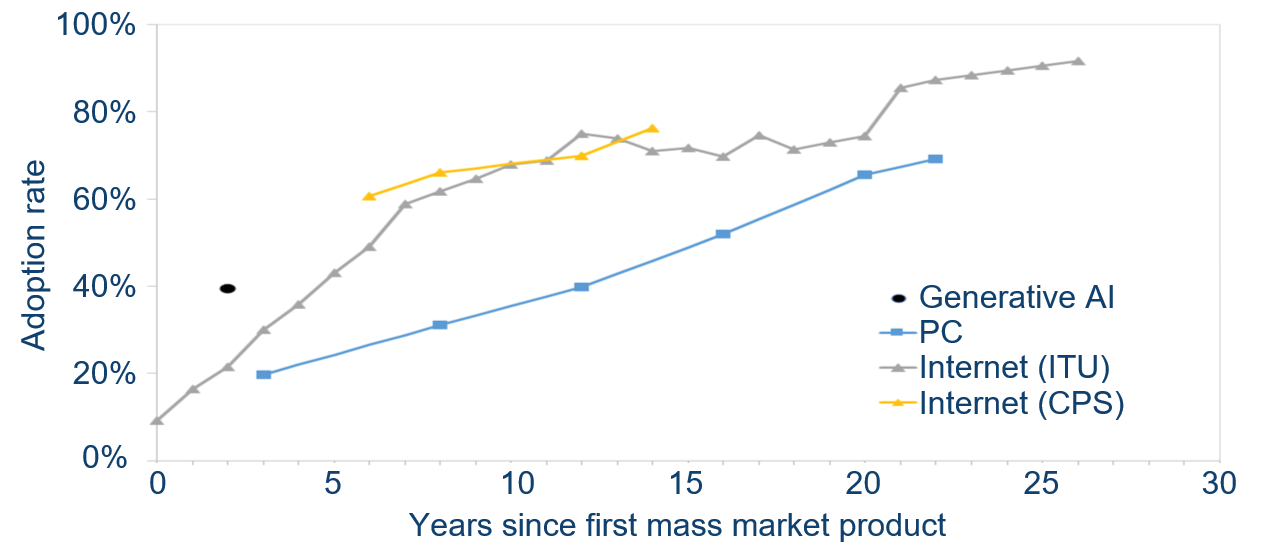

We were early to recognise AI as a general-purpose technology (GPT). GPTs are a distinct category of technology which are widely adopted, spur abundant knock-on innovations and show continual improvement. Historical examples include the steam engine, electricity and information technology, encompassing PCs and the internet. However, adoption of AI has been much more rapid than previous cycles. Two years after launch, generative AI (GenAI) had an adoption rate of c40% compared to the internet’s adoption rate of c20%:

| Adoption of GenAI vs other technologies |

|

| Source: NBER Working Paper Series, February 2025. |

The arrival in the market of Chinese AI model DeepSeek at the start of 2025 caused a short-term setback in equity markets but was soon understood as just another (important) data point indicating the rapid reduction in inference costs (cost per token has been declining by c90% per annum). This cost reduction, together with the improvements in AI models, has in turn sparked an explosion in demand as new use cases and price points emerge.

AI demand and usage is increasing exponentially

More important than being a GPT, we believe GenAI is a textbook example of discontinuous technological progress. These are extremely rare moments (perhaps only 10 in human history) characterised by radical innovation that fundamentally change how industries operate, also leading to the creation of entirely new (current invisible, hard to imagine) market opportunities. These are typically underappreciated and unpredictable because decades of progress are packed into short time periods but, once proven, rapid adoption follows. We believe 2026 will be the year when this becomes obvious to most investors, but the evidence is already mounting.

The past few months have seen an exponential increase in demand and usage of AI. ChatGPT reached 800 million weekly active users in September – up from 500 million in March – and was the most downloaded app for two consecutive months. Meanwhile Google DeepMind’s CEO reported that Alphabet processed nearly a quadrillion (a thousand trillion) tokens in June, more than double the amount processed in May, as Google rolls out its AI search experience and its reasoning models drive significantly higher tokens per use.

| Adoption of ChatGPT versus internet | |

| |

| Source: Financial Times; OpenAI; World Bank October 2025. |

It is becoming apparent that consumers are rapidly adopting AI as an alternative to traditional search. While it took Google 11 years to achieve a billion daily searches, it took OpenAI’s ChatGPT just over two. Today, it handles over 2.5 billion daily searches or prompts.1

Mounting evidence this is not a normal cycle

Underlining all this, cloud-hosting company Oracle recently reported remaining performance obligation (RPO – a measure of contracted revenue), of a staggering $455bn, up 360% year-on-year thanks to contracts signed with several leading AI providers.

OpenAI has subsequently announced partnerships accompanied by huge multi-year contracts with NVIDIA, AMD and, most recently, Broadcom. The size of these deals is measured in gigawatts (GW) of power needed to support them, with each of these deals expected to deliver 6-10GW over 2026-30. To put that into context, New York City’s average load is estimated to be 6GW rising to 12GW at the summer peak.

NVIDIA’s CEO Jensen Huang has suggested that the world will be spending $3-4trn per year on AI infrastructure by 2030, up from <$1trn this year. McKinsey expects 124 incremental GW of AI data centre capacity to be added between 2025 and 2030 at a cost of $7trn.

Investors are understandably concerned by the apparently ‘circular’ nature of some of the OpenAI deals (NVIDIA investing in OpenAI and AMD granting warrants to OpenAI), but looked at another way, these are the companies with the clearest view of the potential of AI and progress towards AGI (artificial general intelligence) or even ‘superintelligence’ and they along with the major hyperscalers are materially accelerating investments.

Passive ETFs and Mag7 are becoming poor AI conduits.

These developments have been reflected in a divergence in equity returns.

During the first phase of GenAI (2023-24), there was an unusually concentrated equity market, dominated by the Mag7 which were perceived to be winners in all areas of the AI race. The Mag7 companies were also supported by robust earnings and cashflow, helped by effective cost control/margin improvement.

In 2024, the Bloomberg Magnificent 7 Index returned 67%, well ahead of global equities, which rose 17.5%2. This benefited investors in tech-related ETFs – such as the Invesco NASDAQ 100-tracker (QQQ US) – but was a notable headwind for active managers.

Since the start of 2025, the improvement in AI model performance and the increasing cost of remaining in the AI race is informing the narrative in both positive and negative ways. As such, market leadership has shifted; the Bloomberg Magnificent 7 Index is up 18.5% and trailing global equities year to date.

Within the Mag7, performance is also diverging. NVIDIA, Meta Platforms and Alphabet have led, Microsoft has done less well and Amazon, Apple and Tesla have trailed. A more selective approach is required as the market is starting to discern which companies are AI winners (enablers or beneficiaries) and which are at risk of being left behind. This presents an interesting opportunity for active managers.

AI infrastructure investment accelerating

In the first half of 2025, AI-related capital expenditure has contributed 1.1% to US GDP growth, overtaking the US consumer as an engine of expansion. For the first time in decades, the contribution to growth from business investment – via AI capex – has rivalled or exceeded household consumption.

Despite spending $447bn between 2022 and 2024, the industry is still AI-capacity constrained which helps explain why capex estimates have continued to move higher. OpenAI has moved first, but we expect other leading participants (hyperscalers and LLM providers) such as Alphabet (Google), Anthropic, Meta Platforms and Microsoft to increase capex significantly in the coming months too.

Unsurprisingly, shareholders of these companies are keen to see demonstrable return on investment, so the path to higher capex may be more gradual. Some of the expenditure will also be captured as operating expenses (lease deals with cloud service providers (CSPs)), due to the urgent need for capacity but also masking the true extent of investment underway.

All this points to being early in a new AI led investment cycle

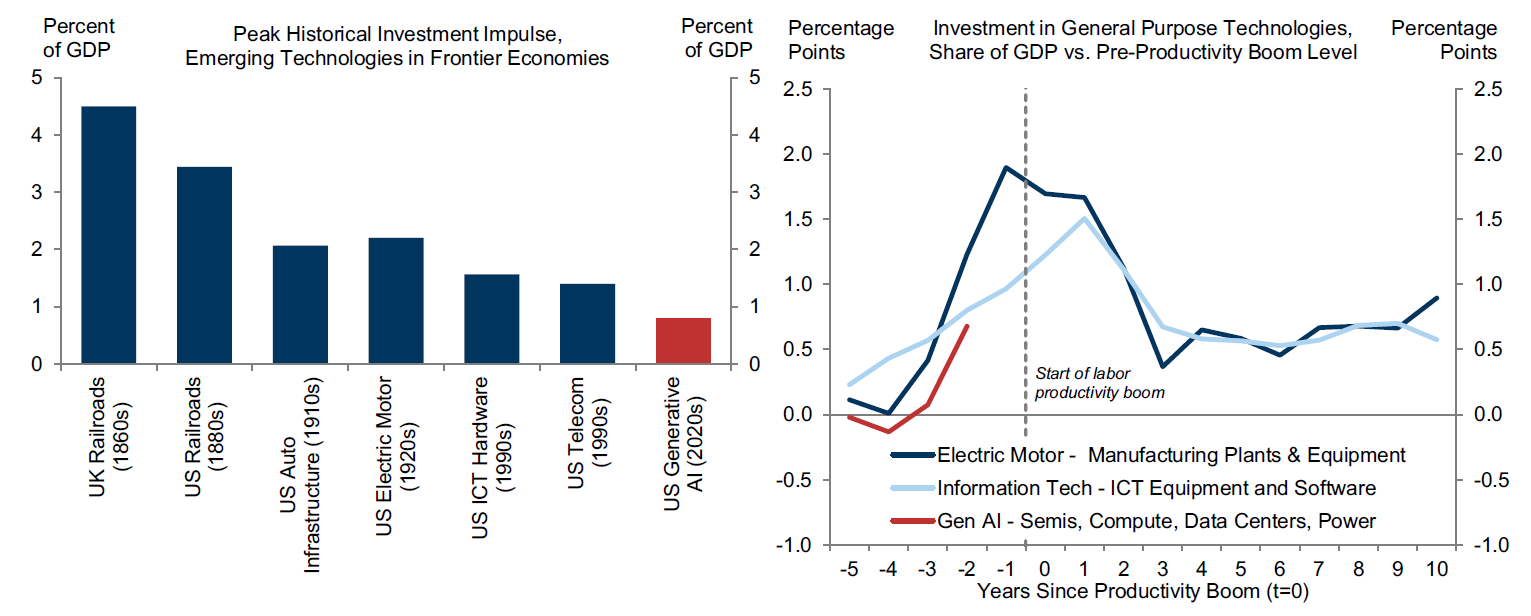

With reference to earlier PC and Internet periods, we believe we remain early in a multi-year infrastructure investment cycle. Goldman Sachs recently published a research paper3 supporting our view, stating “AI investment as a share of US GDP is smaller today (<1% full year) than in prior large technology cycles (2-5%),” before noting that large investment cycles have preceded prior GPT productivity booms.

| Investment in general purpose technology |

|

| Source: Goldman Sachs Investment Research, Bureau of Economic Analysis October 2025. |

Broadening investment opportunities

AI investment is expected to reach $3trn in global data centre spending by 2028, excluding associated power infrastructure, according to Morgan Stanley. Despite this unprecedented buildout, demand continues to outstrip supply, extending beyond data centres into the broader energy and infrastructure ecosystem. We see compelling opportunities in power generation, grid modernisation, advanced cooling and efficiency technologies, reflected in our holdings such as GE Vernova, Rolls-Royce Holdings and Vertiv Holdings.

Goldman Sachs projects that the rapid expansion of AI workloads will drive a 165% increase in power demand by 2030 relative to 2023, with around 60% of future requirements necessitating new generation capacity. Shortages in turbines, transformers, cooling systems and memory chips remain key bottlenecks, but the data points and the magnitude of spending commitments for the AI story continue to surprise to the upside, signalling the intensifying AI arms race.

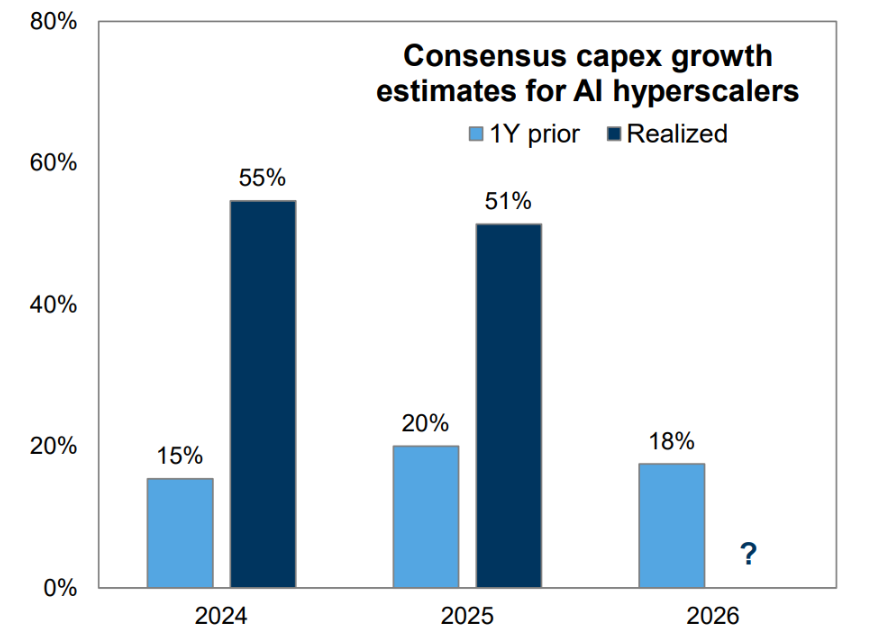

Estimates were too low, even before the recent deals

Entering 2024, AI capex was expected to grow by just 15%, yet it ultimately surged 55% year-on-year. The same pattern has persisted into 2025: initial forecasts of +20% have already been revised sharply higher, with Goldman Sachs now projecting growth above 50%. Looking ahead to 2026, consensus expectations of 20% growth again appear overly cautious.

Analysts often extrapolate linearly, underestimating the inherently non-linear, discontinuous nature of technological adoption. With OpenAI’s next wave of contracts ramping in H2 2026, we believe current capex estimates significantly understate the scale of the coming investment phase.

| Capex growth for AI hyperscalers | |

| |

| Source: FactSet, Goldman Sachs Global Investment Research, 2 September 2025. Hyperscalers include AMZN, GOOGL, META, MSFT, ORCL. |

AI: an existential threat to software stocks?

On the negative side, incumbent technologies are facing challenges from AI disruption. We believe this is becoming apparent in SaaS (software-as-a-service) companies, where growth rates are slowing and valuation multiples compressing. The risk here is not only challenges posed by headcount-based revenue models (when AI displaces jobs), but that software in its simplest form is an interface or tool for humans to manage and access data.

Unsurprisingly, AI-enabled competitive solutions are gaining traction at a fast pace. Coding tools are a good example. It is reported that users of Cursor, an AI code editor, are already generating a billion lines of code every day. At Microsoft, 35% of the code required for new software is already AI-generated. This has been reflected in share price performance. We have seen recently that even mildly disappointing SaaS company earnings reports have been punished heavily.

Once you understand, you need a new portfolio

Once you understand this is a period of discontinuous technological progress, it becomes clear a new portfolio is going to be required. AI demand is exceptionally strong and while most companies are talking a good game, the market is rewarding those who are delivering.

This plays to our strength with one of the largest technology investment teams globally. Equally importantly, eight years managing a dedicated AI fund has helped shape our perspective and given us invaluable insights.

This led us to aggressively shift the portfolio over the past 18 months.

We know from previous cycles that avoiding losers is critically important. As a result, the Fund’s exposure to software (less than 10%) is the lowest it has been in a decade. Instead of investing in software companies, we have been investing in broader AI enablers.

The Fund is also underweight the Mag7 in aggregate – with larger positions in NVIDIA, Meta Platforms and Alphabet offset by much smaller exposure to Microsoft, Apple, Amazon and Tesla. That said, the risk of being materially underweight is partially mitigated through selected use of out-of-the-money call options, which are currently augmenting the Fund’s Alphabet, Apple and Microsoft positions.

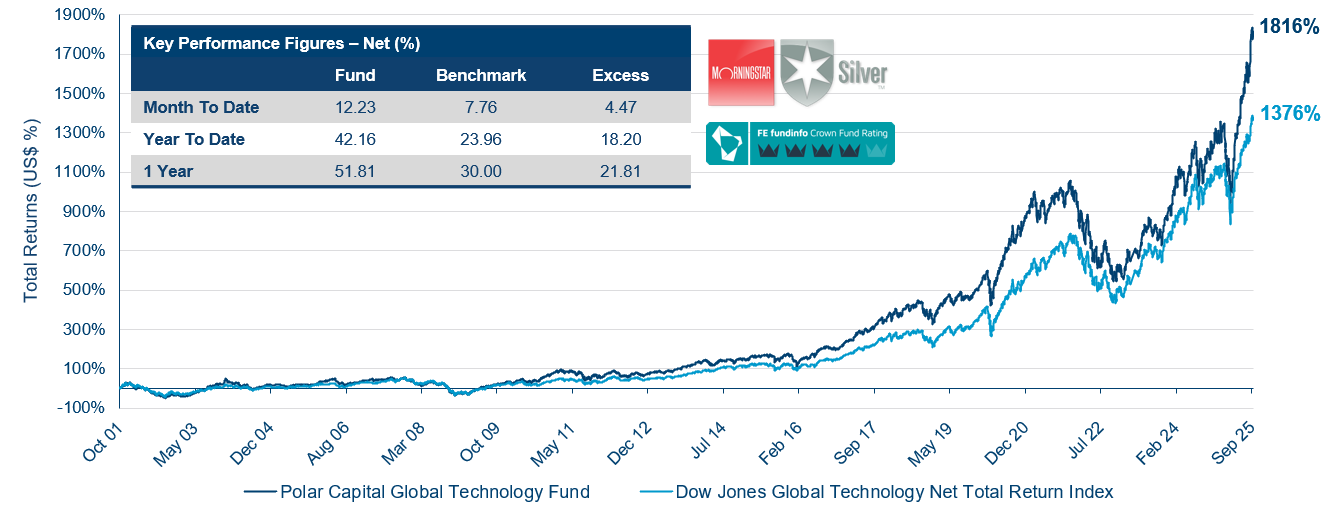

With this positioning, the Fund (USD I Dist Share Class) has returned 42.16% since the start of the year to the end of September, well ahead of its benchmark, the Dow Jones Global Technology Net Total Return Index, which has returned 23.96% (both figures in US dollar terms).

Polar Capital Global Technology Fund (I USD) vs Dow Jones Global Technology Net Total Return Index |

|

Source: Polar Capital, 30 September 2025. Northern Trust International Fund Administration Services (Ireland) Ltd, monthly percentage growth, I USD. Performance is representative of the Institutional USD share class which launched on 4 September 2009. Prior to this the performance figures are representative of the USD share class which launched on 19 October 2001. The index performance figures are sourced from Bloomberg and are in US$ terms. Performance data takes account of fees paid by the fund but does not take account of any commissions or costs you may pay to third parties when subscribing for or redeeming shares or any taxes or securities account charges that you may pay on your investment in the fund. Such charges will reduce the performance of your investment. A 5% subscription fee can be charged at the Investment Managers discretion. |

What does AI mean for jobs and the economy?

Doug McKillon, CEO of Walmart, recently stated: “It’s very clear that AI is going to change literally every job,” while expressing plans to maintain employee numbers of 2.1 million globally over the next three years and upping AI training to “create the opportunity for everybody to make it to the other side”. Of course, the jobs market will be impacted by AI, but we believe AI is getting credit for too much short-term disruption and not nearly enough in terms of longer-term productivity benefits. We also see potential for a stronger economy in 2026, led by robust capex investment, aided by the One Big Beautiful Bill-accelerated depreciation initiatives that are being widely overlooked.

Outlook: No ordinary tech cycle

Our conviction in AI’s proliferation is based on the fundamental data points we monitor, which remain strong as we head into third-quarter earnings season – but it is the longer-term opportunity that excites us the most. Scaling laws suggest AI model performance will continue to improve at a rapid pace which will increase the value and applicability of AI, helping investors better understand the return on AI investment. The significant productivity benefits this enables could also unleash a period of disinflationary growth and a sustained period of stronger than expected GDP growth.

We are hopeful that current China/US trade tensions, including additional tariffs and restrictions – such as rare earth exports – represent further posturing ahead of a potential trade deal, but after such a strong run this uncertainty is creating near-term market volatility. We expect to use any setback to reposition ahead of a seasonally strong period for markets.

It is also important to remember that volatility is a normal feature of new technology cycles. Between 1995-98 – the early years of the internet infrastructure buildout but before the dot.com bubble – the NASDAQ gained 354%. However, this strong period was punctuated by seven corrections of greater than 15% during the period. We believe the current backdrop remains highly reminiscent of the mid-, rather than late 1990s.

Put differently, while there are clearly some pockets of overexuberance and chatter about a so-called AI bubble, we strongly believe this is the end of the beginning rather than the beginning of the end.

Having spent nearly three decades in the industry, Ben and I believe that AI represents the most transformative technological development of our careers. The pace of innovation is extraordinary – AI model improvement is now outstripping even Moore’s Law at its peak.

With its capacity to reshape knowledge work and redefine productivity, we retain the high conviction that GenAI will prove to be the defining investment theme of this decade. While we expect this to become even clearer through 2026, the evidence that this is no ordinary technology cycle is already undeniable.

Forecasts are based upon subjective estimates and assumptions about circumstances and events that may not yet have taken place and may never do so.

1. ChatGPT users send 2.5 billion prompts a day | TechCrunch

2. MSCI ACWI, Bloomberg and Polar Capital

3. US Economics Research, 15 October 2025