“I'm pleased and happy to report the news that we have, in fact, caught and killed a large predator that supposedly injured some bathers. But, as you see, it's a beautiful day, the beaches are open and people are having a wonderful time”

– Mayor Vaughn, Jaws

The first splash

Credit markets have been softer since the news of the bankruptcies of Tricolor, a US subprime auto lender, and First Brands Group, a US auto parts company. The weakness has been latterly exacerbated by President Trump turning up the dial on tariffs with China. At last, this is the evidence that the credit bears have been looking for with all things related to the explosion of growth in private credit to be a ‘Potemkin village’. It will get worse and it is time to get out of the water while spreads are still tight. Or is it?

On a closer look, it would be fairer to say – as in Scottish legal parlance – that the case is ‘not proven’. The two failures were in part due to alleged fraudulent activity and/or weak business models. In the first instance, it was a case of lending to those without the means to repay. In the second, it is fair to say that the borrower had a number of ‘red flags’. This gives credence to the fact that these failures are – so far – idiosyncratic and not a sign of stress building up in corporate America.

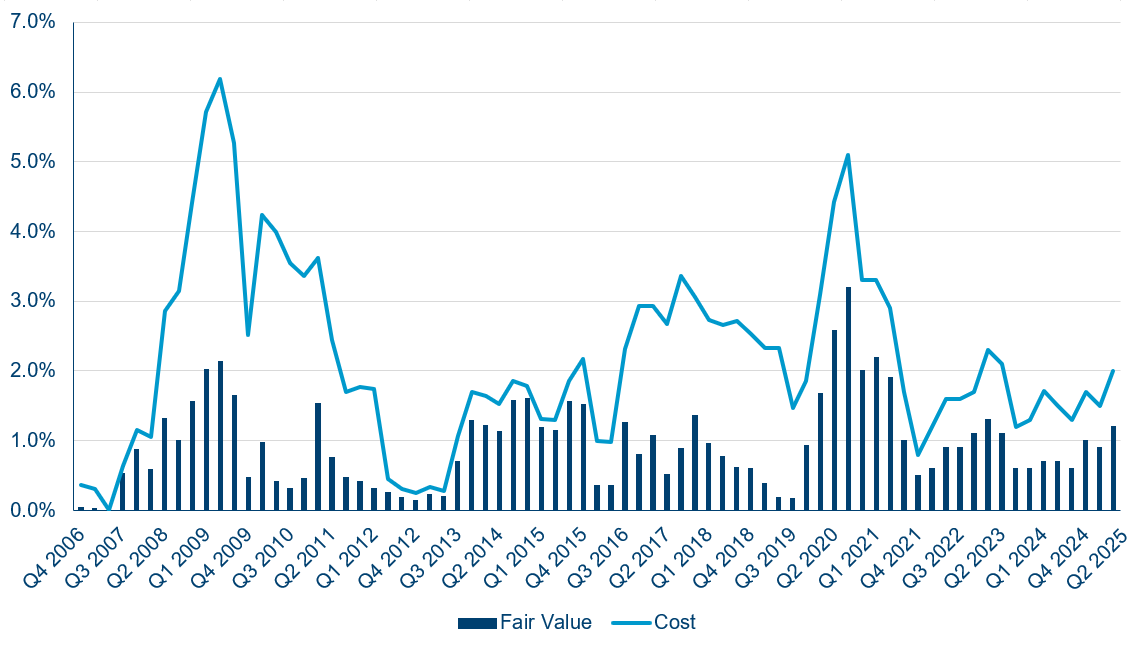

However, this does not mean investors should be complacent. US economic data has been mixed. GDP has shown decent growth but is much weaker once you strip out the impact of AI capex. US employment data has steadily been weakening, as evidenced by the huge negative revisions, so there are parts of the US economy where all is not good. There have also been plenty of other credit losses, just not attracting the same publicity as Tricolor and First Brands. Given the economic background, that should not be a surprise and, importantly, so far the losses look contained. This can be seen in the chart below, using data from Ares Capital, the largest publicly traded BDC (business development company1) and a good reflection of historic trends for private credit.

Ares Capital non-accruals |

|

| Source: Ares Capital, Polar Capital, data to the end of June 2025. |

Calm beneath the surface

Are there any other smoking guns? Major banks think not. In answer to a question on the health of the US consumer on their Q3 earnings call, Jeremy Barnum, JP Morgan’s CFO, stated: “The current facts on the consumer side is resilient, spending is strong and delinquency trends are coming in below expectations. So, these are the facts that we really can’t escape.” However, this and other positive comments and data on delinquency trends in US bank Q3 earnings was unsurprisingly overshadowed by JP Morgan’s CEO Jamie Dimon’s comments about the two losses: “I probably shouldn't say this but when you see one cockroach, there are probably more.”

Subsequently, Zions Bancorp*, a large US regional bank, warned about two losses, one of which it only became aware of as Western Alliance*, a smaller California-based peer, had taken one of the borrowers to court. For Zions Bancorp, provisions and charge-offs totalling $60m are small against a loan book of $61bn. However, it was enough to lead to a savage selloff in US regional bank shares as investors worried that these are no longer isolated incidents.

Nevertheless, corporate and household balance sheets remain in better shape than they have been for decades. Across the US and Europe, private sector debt levels have fallen substantially over the past 15 years – the mirror image of soaring government debt. Corporate cashflows remain very strong and the speculative excesses that typically precede recessions are absent. As a result, we do not see these incidents as indicators of further losses unless there is more weakness in economic data. Even then we expect any downturn should be relatively shallow, all things being equal.

Against this background, credit spreads have narrowed to post-global financial crisis lows, although they remain wider than pre-crisis levels. Yet fundamentals today are stronger on almost every measure. Banks now hold significantly more and better quality capital, with more liquidity and loan books underwritten on much tighter criteria. Profitability has also improved materially. Taking all this into account, tighter spreads are easily defensible.

Financial bond spreads (bps) |

|

| Source: ICE BofA, Polar. 15 October 2025. ICE BofA Global Financial Index. |

In recent weeks, however, several new issues have come to the market that we felt offered limited value. In the UK we would include Aldermore*, a UK specialist bank that issued an inaugural Tier 2 bond at a yield of 8.5% in 2015 and yet today was able to issue at 6.0% despite the overhang of motor finance claims. Similarly, Viridium*, a German life assurance consolidator with significant exposure to US private credit, priced a euro issue at 4.375%. We avoided these issues and found value elsewhere from less well-known issuers such as Hampshire Trust Bank which issued a Tier 2 bond at 8.125% and Trustly, a Swedish payments company at 8.78%.

It is also worth remembering that this is not 2021, when all-in yields were very low. Today, yields still look reasonable given the outlook for inflation and interest rates.

US dollar financial bond yields (%) |

|

| Source: ICE BofA, Polar. 15 October 2025. ICE BofA Global Financial Index. |

Against this background, the Polar Capital Financial Credit Fund continues to have its largest exposure to Senior and Tier 2 bonds where we see the best value, with very limited exposure to AT1 and RT1 bonds (7% of the Fund) where we see nervous holders with fingers hovering to sell at the first whiff of trouble. The average credit rating of the portfolio is A-.

As for the potential trigger, we cannot forecast that but possibilities include: the US Supreme Court decision on 5 November about the legality of President Trump’s tariffs; a meeting with Trump and President Xi ending badly at the APEC conference in South Korea later this month; or any other unforeseen geopolitical event. However, in that environment, we would expect credit to hold up materially better than other asset classes, which are stretched on almost every valuation metric possible. In the meantime, credit should continue to eke out bond-like returns to reflect the bond-like risk being taken.

Drawdowns in financial and corporate bonds (%) | ||||||

| Spring 2016 | Spring 2020 | Spring 2022 | Early Autumn 2022 | Spring 2023 | Spring 2025 | |

| Financial Senior & Tier 2 | -0.4 | -10.1 | -3.4 | -5.5 | -2.6 | -1.2 |

| Corporate Investment Grade | 0.3 | -11.2 | -4.2 | -6.4 | -2.3 | -1.6 |

| Corporate High Yield | -4.1 | -23.7 | -5.7 | -7.3 | -4.0 | -2.9 |

| Financial AT1 & RT1 | -10.6 | -29.1 | -8.6 | -10.7 | -18.9 | -3.9 |

| Source: ICE BofA; Polar Capital. October 2025. (The darker the red, the larger the drawdown.) Note: Financial Senior & Tier 2 is ICE BofA Global Financials Index (G0BF); Corporate Investment Grade is ICE BofA Global Corporate Index (G0BC); Corporate High Yield is ICE BofA Global Non-Financial High Yield Index (HN00); Financial AT1 & RT1 is ICE BofA Contingent Convertible Index (COCO); Spring 2016 is 31 Dec-12 Feb 2016; Spring 2020 is 12 Feb-23 Mar 2020; Spring 2022 is 5 Jan-7 Mar 2022; Early Autumn is 12 Aug-3 Oct 2022; Spring 2023 is 2 Feb-20 Mar 2023; Spring 2025 is 2 Apr-9 Apr. | ||||||

* not held.

1. Business Development Companies (BDCs) are investment vehicles that provide funding to small, medium-sized private equity-backed companies.