AT1s have had a terrific 21 months. If you had bought a portfolio of the bonds the morning after Credit Suisse’s own AT1s were written down to zero, it would have returned 40.6%1. Effectively you have had equity-like returns for bond-like risk. This should not be a surprise as at the time AT1 bonds yielded 10.3%, a pick-up over government bonds yields of 709bps. Be greedy when others are fearful.

But they are risky, no? Well, according to regulators, yes. The FCA sees them as weapons of mass destruction2, banning retail investors from owning them – putting aside the fact these same investors can buy much riskier asset classes including emerging markets, buy European bank ETFs or trade CFDs. Australian regulators have even gone a step further and called it a day on AT1 bonds, phasing them out as of capital for banks from 2027.

We think this risk is misplaced. Today, capital ratios and profitability are at their strongest levels in years, driven in part by higher interest rates, while loan books have been materially derisked, with bad debts now at historically low levels – as referenced by the European Central Bank and Bank of England in their respective Financial Stability Reviews, published in November 2024.

Financial companies are not immune from a cyclical downturn, but as KBW’s UK banks analyst succinctly commented in a recent note: “UK banks have survived a fall in GDP of 10%, interest rates rising by 5% and inflation peaking at more than 11% with zero credit problems”. Crucially, this analogy is applicable across a number of other banking markets.

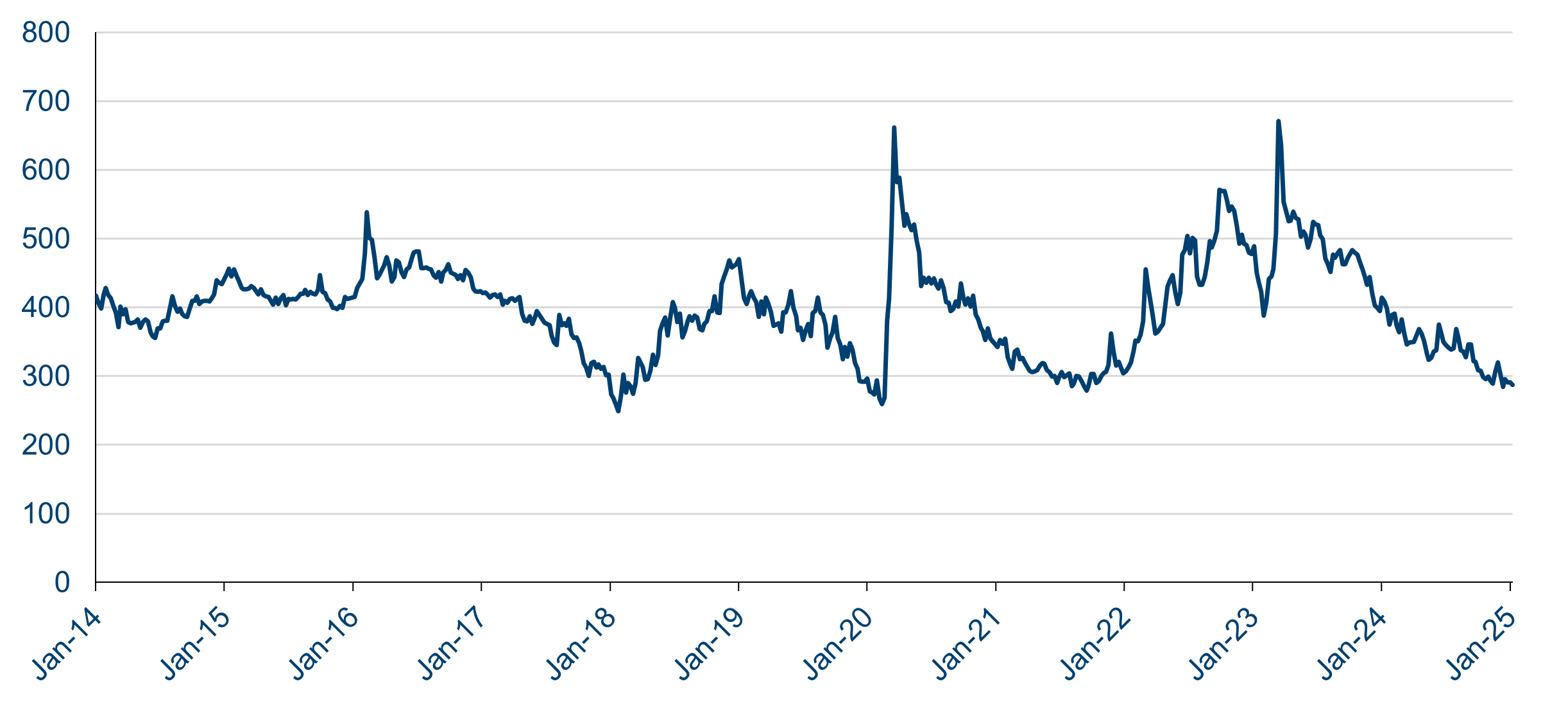

The consequence of the strong performance, however, has been a significant tightening in spreads.

| History of AT1 bond yield spreads |

|

| Source: ICE BofA, spread to worst (US$); 20 Jan 2025. |

Could we see a further narrowing? Absolutely. Financial companies not only do not default that frequently, with statistics from Moody’s showing it occurs less than half the time of non-financials, but spreads were also tighter pre-2007. Furthermore, thanks to an increase in government bond yields, the overall yield on offer is still relatively attractive – 6.6% as of 16 January 2025 (on a US dollar basis).

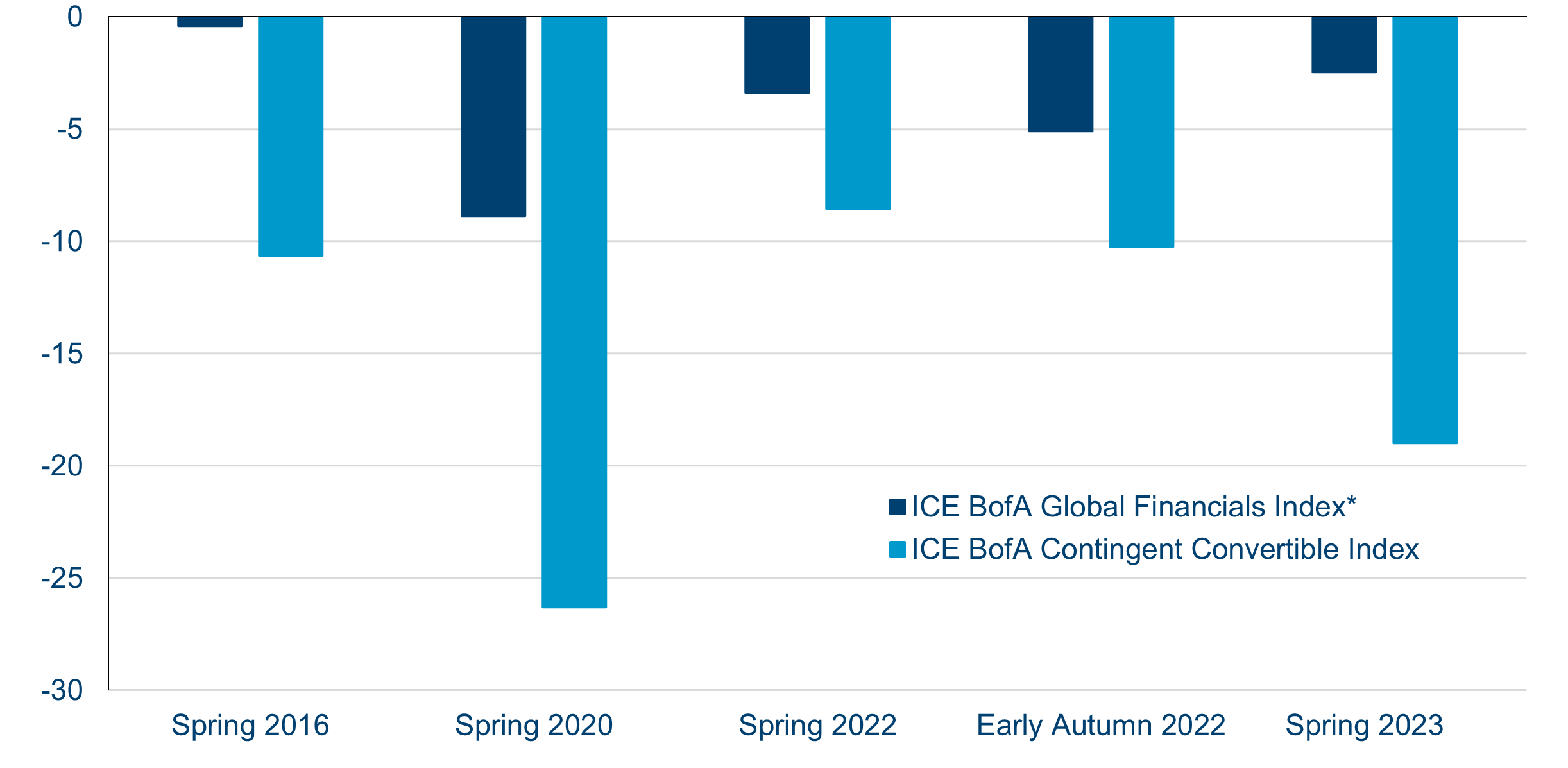

AT1s are, however, not without risks. To date, c95% of banks have called3 their AT1s at the first opportunity, making the instruments relatively short-dated. However, in risk-off environments, the probability of a bank not calling its bonds increases and the bonds become priced more like perpetuals – which they fundamentally are. AT1 coupons are discretionary so the fear they are suspended, albeit very small, will increase in a selloff. This combination on performance in risk-off events can be seen below.

| Largest drawdowns in financial bonds over the past 10 years |

|

| Source: ICE BoA; 20 Jan 2025; *The ICE BofA Global Financials Index consists principally of senior (82%) and tier 2 (15%) bonds. |

Today, AT1 bonds offer bond-like returns for bond-like risk, but with the tail risk that you could suffer a sharp drawdown in a risk-off environment, despite strong fundamentals.

Where do we see better value?

- Higher up the capital stack in Tier 2 and senior bonds

- In UK financials, where spreads remain wider

- Across peripheral European banks

- In some smaller and mid-sized financial institutions

- In the remaining buckets of legacy debt4

1. ICE BofA Contingent Convertible Index 20 March 2023 to 20 January 2025 USD Hedged

2. The FCA would describe them as "risky and highly complex instruments"

3. AT1 bonds are perpetual instruments issued with call dates normally five years from the date of issue where the bank has the right, but not the obligation, to call the bond back at par. If it does not, the coupon will reset to a set yield above the prevailing five-year government bond at that time

4. Legacy debt is so-called as the securities in question no longer count towards regulatory capital