Over the past nearly four decades, we have seen a significant pullback in healthcare stocks during three distinct periods: early 2003, following the bursting of the tech bubble, 2015-16, driven by political rhetoric and pricing pressure fears, and now. The earlier periods were followed by a bull market for healthcare stocks and we see today as another active entry point into a sector that we feel is strongly dislocated from its fundamentals.

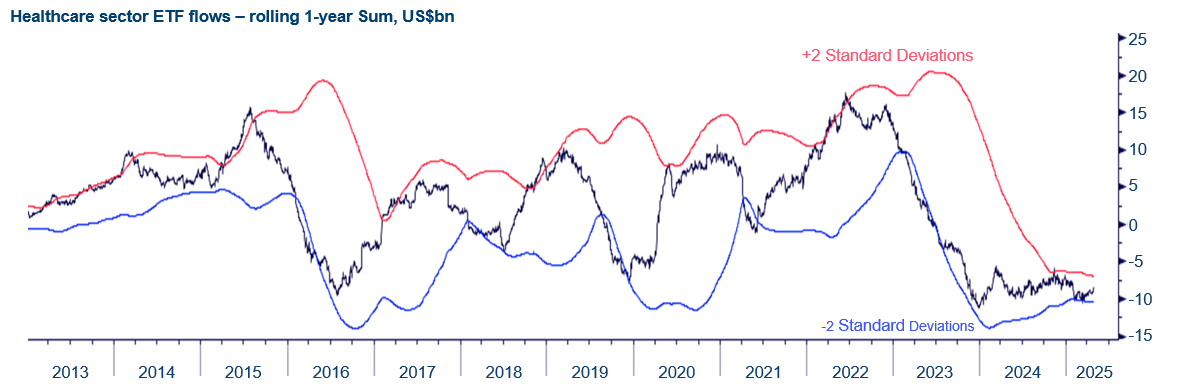

Sentiment right now is on its knees, as you can see here from ETF outflows that have been extreme for a while now. Any turn in relative performance should be followed by a boost in sector flows. We see these flow charts as interesting in their own right, particularly as a powerful contrarian indicator.

| ETF flows a powerful contrary indicator |

|

| Source: Strategas ETF Research, Bloomberg, 01 May 2025. RSPH US Equity (Invesco S&P 500 Equal Weight Health Care ETF) HC 250d Flows, daily 31 December 2012 - 01 May 2025. |

To us, healthcare stocks are attractively priced. There are obvious headwinds for the sector – US policy risk being one of them – but we could soon reach or already be at ‘peak fear’. Importantly, there are powerful tailwinds, including a vast array of new product launches across various sectors such as medical devices and pharmaceuticals. Long-term growth drivers are also very much intact with consolidation, prevention and emerging markets prime examples. The medium and long-term investment opportunity for healthcare, we believe, is compelling.

How did we get here – if ‘here’ is the challenge of being bottom decile when looking at a rolling five-year performance? Most immediately it has been through a combination of Donald Trump, Robert F Kennedy Jr, and Elon Musk creating huge uncertainty, not just in healthcare but across many other markets which seemed to catch everyone by surprise.

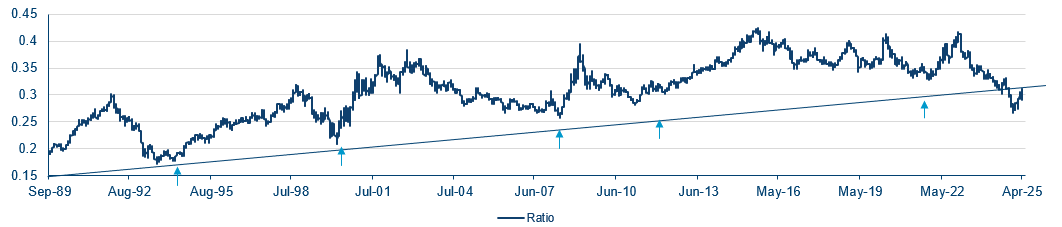

| Relative performance trend signals a ‘buy’ for the sector |

|

| Source: Strategas Technical & Macro Research, Bloomberg, 01 May 2025. S5HLTH Index (S&P 500 Health Care Sector GICS Level 1 Index) HC vs SPX 3YR, Weekly 31 December 1994 - 01 May 2025. |

There is a mea culpa here because as we headed into this year, we thought a Republican trifecta would be broadly positive for healthcare and we certainly did not expect the levels of volatility we have seen. However, it is important to note in the absence of Congressional support and changes in legislation, we think that widespread draconian changes to healthcare are probably unlikely.

There is a correlation in the relationship between returns and policy fears which, looking at the chart below, shows it can be rewarding when you invest above the green line. The dramatic spike showing the selloff in late 2024 encourages our argument that policy fear is reaching some sort of peak, meaning the return profile from here could be attractive.

| Invest when policy uncertainty is at its highest |

|

| Source: US monthly Economic Policy Uncertainty (EPU) Index; https://www.policyuncertainty.com/us_monthly.html. 31 May 2025. |

We also do detailed technical analysis. The chart below looks at the relative performance of the S&P 500 Health Care Index versus the S&P 500. It shows that every seven or eight years, we have a cycle where we get this technical support and the sector does well. For example, in the early 1990s, there were concerns that Hillary Clinton would introduce reform. She failed. The sector recovered. In the early 2010s, Barack Obama introduced The Affordable Care Act – Obamacare – but once we had visibility on the investment landscape, the sector recovered.

S&P 500 Healthcare Index vs S&P 500 Index |

|

| Source: Polar Capital, Bloomberg as at 30 April 2025. |

Looking at the far right-hand side of the graph, you can see we are roughly at that support level so, if the fundamentals remain intact and we see some of these transient headwinds, we believe that now could be an important inflection point for the sector on a relative basis.

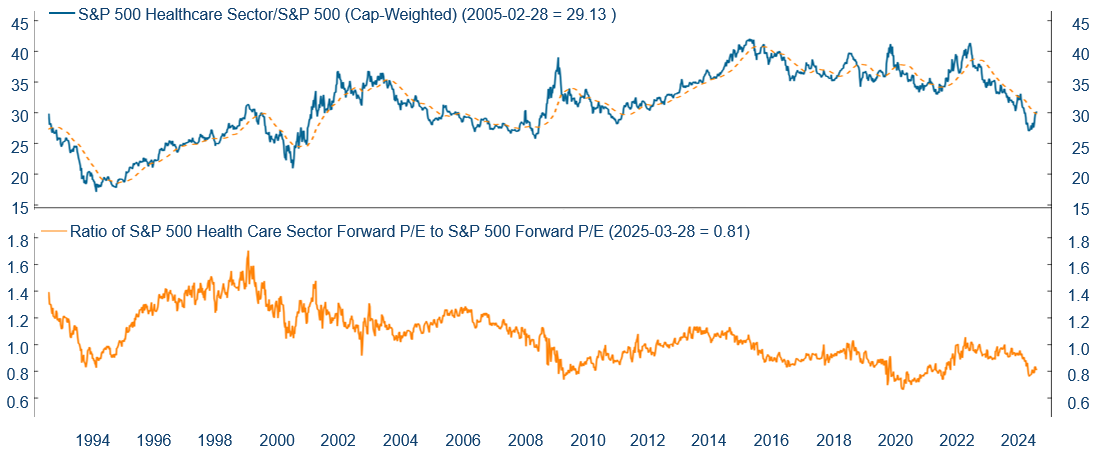

Valuations (price to earnings) show the healthcare sector is at a c20% discount so, in absolute terms is fairly attractive and in relative terms is very attractive. We believe that as long as the sector can deliver earnings growth, it should do reasonably well from here – valuations should not be a reason not to engage.

S&P 500 healthcare sector relative forward price to earnings (P/E) ratio |

|

| Source: Ned Davis Research Inc., 03 January 1992 to 25 April 2025. Sector earnings estimate calculated by NDR using available mean 1-year forward earnings estimates for sector constituents. Copyright 2024 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. |

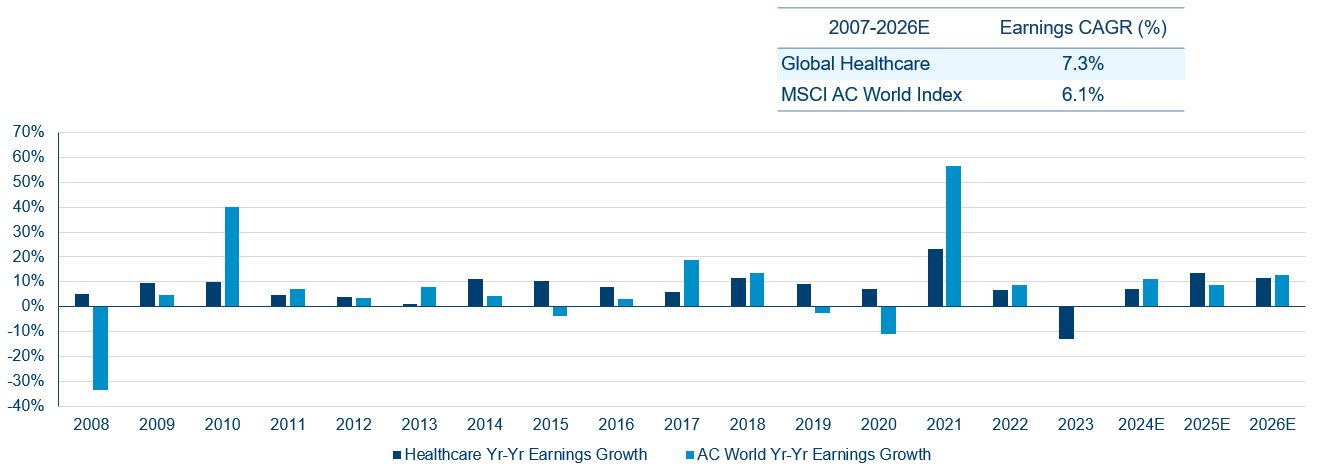

Finally, the chart below looks at two things, an absolute level of growth and the consistency of growth. The dark blue bars look at year-on-year earnings growth that has been very consistent for the healthcare sector. We did have some exceptions – in 2021 and 2023, primarily driven by COVID, as the market and the world thankfully realised it does not need so many vaccines or tests or manufacturing. We think the underlying picture is robust. If you look at the estimates for 2025, the data points to a sector that delivers slightly better earnings.

Large-cap healthcare has a record of superior growth |

|

| Source: Citi Research, 30 April 2025. |

The key drivers for our sector remain in place.

- Delivery disruption is something we talk about consistently, the idea of being able to treat a patient away from a hospital using technology. We think that is going to be an important and durable growth driver.

- We think the healthcare sector is also very innovative, not just in pharmaceuticals but with medical devices too.

- The sector has strong balance sheets and is highly fragmented – two of the main ingredients for consolidation. Companies are often agnostic to the source of innovation or R&D, so are looking for external assets as well as internal developments. We think you will continue to see consolidation.

- Emerging markets are an incredibly important driver of growth as well. It is extremely heterogeneous, but the underlying theme of a growing, ageing population with greater healthcare demands is consistent.

- Outsourcing will probably continue. Companies will stick to their knitting, outsourcing non-core activities such as manufacturing.

- Prevention, i.e. not just vaccines, but also diagnostics. Can we diagnose a patient? Can we put them on the right treatment path? Can we drive better outcomes?

We think all these long-term drivers are still intact, underpinning the idea that healthcare is a durable long-term growth sector.

Outlook

We think healthcare is bruised but not broken. The sector may be heavily out of favour but, for the most part, fundamentals are intact and we need to navigate through a few near-term transient headwinds.

The demand for therapeutics, medical devices, technology and services continues to be strong. The industry is investing in R&D, it is innovating and developing much-needed solutions for complex problems. The political, regulatory and macro-insurgencies have contracted valuations, but for us that is simply creating really exciting medium and long-term investment opportunities.

To our mind, key secular drivers of sustainable growth remain firmly intact and indeed some may be even accelerating. Conviction that healthcare is a compelling medium and long-term opportunity set is high and we will certainly be looking to take advantage of the widespread apprehension we are seeing today.