Nearly two decades to the day since Richie Benaud commented on his last game of cricket for British television (a game that saw England finally reclaim the Ashes), the Australian Prudential Regulation Authority (APRA) has announced it is ‘time to say goodbye’ and exclude the Additional Tier 1 (AT1) asset class from its capital framework.

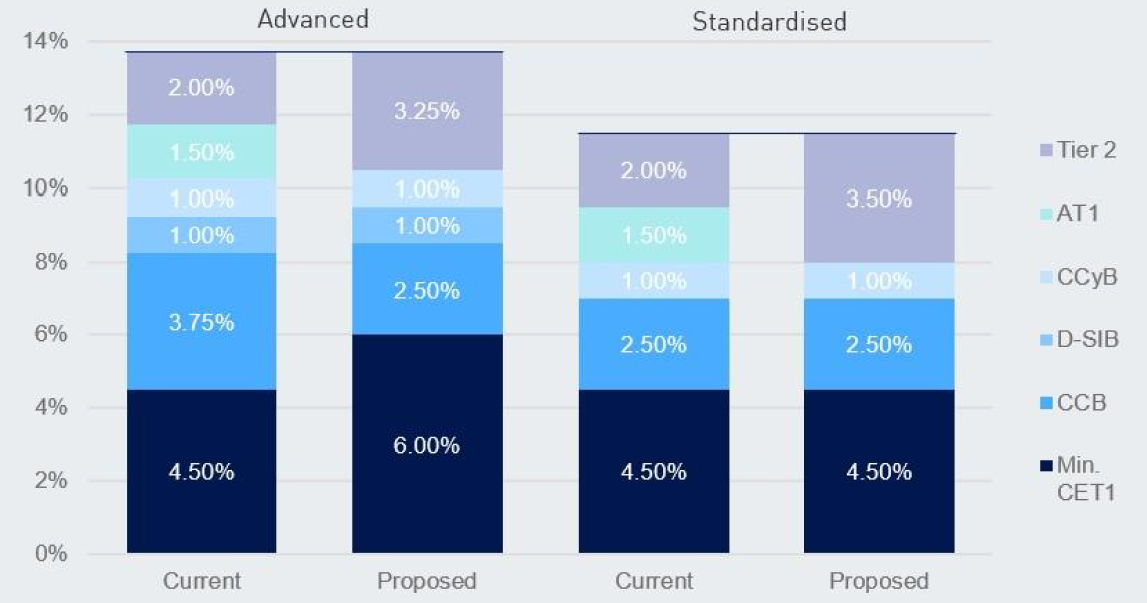

Although still subject to a two-month consultation period, APRA’s proposals involve the complete phasing out of AT1s from January 2027, with all outstanding instruments to be replaced by 2032. In place of the current 1.5% minimum requirement, APRA has recommended an increase in Common Equity Tier 1 (CET1) and Tier 2, as illustrated in the table below.

Overall, regulatory capital requirements will, however, remain unchanged.

For six Australian banks currently classified as ‘Advanced’, due to their use of the internal ratings-based approach to credit risk capital requirements, the proposed approach will:

- Replace the existing 1.5% AT1 requirement with 0.25% CET1 and 1.25% Tier 2; and

- Increase the minimum CET1 requirement from 4.5% to 6%, but offset this by removing the 1.25% advanced portion of the capital conservation buffer (CCB). This would ensure the minimum Tier 1 and CCB requirements of 6% and 2.5% respectively are maintained, in line with Basel minimum standards.

For the smaller Australian banks utilising the standardised approach to risk weights, the AT1 requirement will be fully replaced with Tier 2 capital and the minimum Tier 1 requirement will be removed.

Current vs proposed frameworks |

Simplifying the capital framework by replacing AT1 with other existing, more reliable forms of capital Banks are required to meet the capital conservation buffer (CCB), domestic systemically important bank (D-SIB) buffer, and the countercyclical capital buffer (CCyB) with Common Equity Tier 1 (CET1) Capital. These capital stacks exclude additional loss-absorbing capacity requirements. |

| Source: Australian Prudential Regulation Authority: A more effective capital framework for a crisis. |

Why such a radical change?

In APRA’s prudential framework, AT1 has two fundamental roles: (1) stabilising a bank so it can continue to operate as a going concern during a period of stress; and (2) supporting resolution with the capital that is needed to prevent a disorderly failure.

International experience in 2023, however, showed that AT1s, in their current form, could not fulfil these roles, with the instruments only absorbing losses when the point of non-viability was imminent.

With the option of redesigning AT1s ruled out because of the associated costs and complexity to implement effectively, APRA has opted for their complete removal from the capital framework.

Implications for Australian sub-debt

Tier 2 instruments have historically been cheaper to issue than AT1s, due to their fixed term, mandatory coupons and more certain call treatment, with capital eligibility amortising on a straight line basis over the past five years. Their cost is, however, likely to increase marginally with the removal of AT1s. This reflects not only the fact that banks will have to issue more (with APRA estimating that cAUD36bn will be needed to replace current outstanding AT1s between now and 2032), but also the increased subordination of the instrument in the capital stack which could in turn result in downward rating pressure.

The Polar Capital Financial Credit Fund currently owns National Australia Bank’s £600m, A- rated 1.699% Tier 2. The bond, however, has its first call date in September 2026, before the potential introduction of APRA’s new capital framework. As a result, we believe any price reaction to these announcements will be muted.

Implications for AT1s north of the equator

Central banks, regulators and finance ministries across Europe have been opining on the suitability of the asset class in recent years. Indeed, in March 2024, it was the turn of the Dutch Finance Ministry to indicate that it was exploring the possibility of modifying or abolishing AT1s completely. This followed comments by the Swiss National Bank, the Bank of International Settlements (the central bank’s bank), the European Central Bank and the Bank of England (BoE).

Despite these musings, however, we continue to consider any significant changes in Europe to be highly unlikely over the short to medium term given the lack of international agreement, deemed a pre-requisite of regulatory amendments by the BoE when its suggestions were first posited.

Furthermore, Australia is already an outlier internationally with regards to AT1s, with a material proportion of the instruments held by domestic retail investors; concerns about their behaviour in the event of any write-down was also a material contributor to APRA’s proposals.